终于用上claude code了,看看账号能撑几天🤣

0xBi

用户暂无简介

0xBi

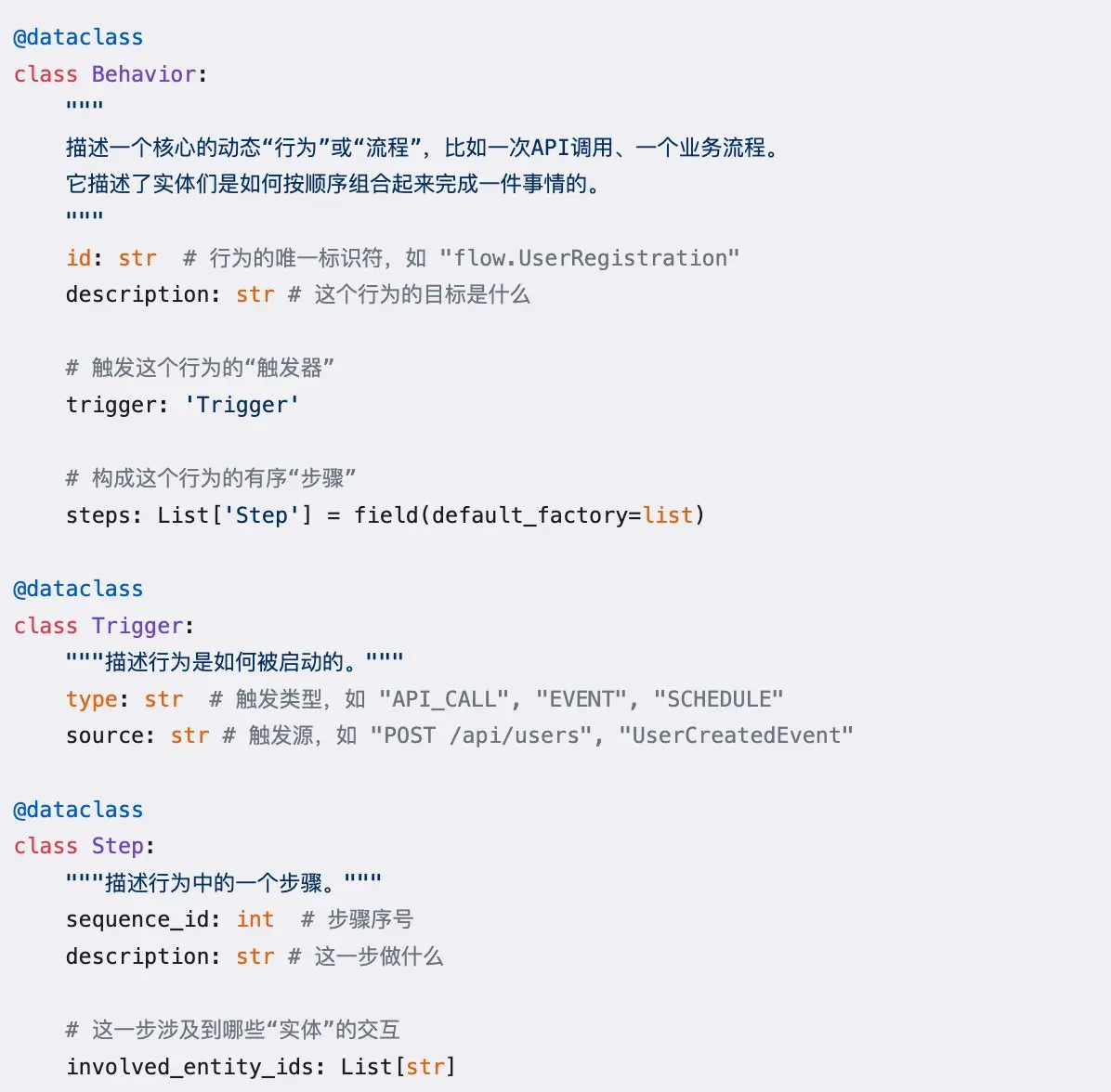

关于Vibe Coding的暴论:之前主要是人来写代码,所以文档用人容易懂的非结构化方式组织,但是传统文档信息表达的浓度,精度,可维护性都不是最优解。考虑之后AI会接管很多代码工作,那就会出现AI 时代的代码文档 -围绕实体、关系和行为构建代码,代码即文档

- 赞赏

- 点赞

- 评论

- 分享

- 赞赏

- 点赞

- 评论

- 分享

计划的双买仓位进了60%,等一周不出波动就再进40%。2周不出波动就止损

- 赞赏

- 点赞

- 评论

- 分享

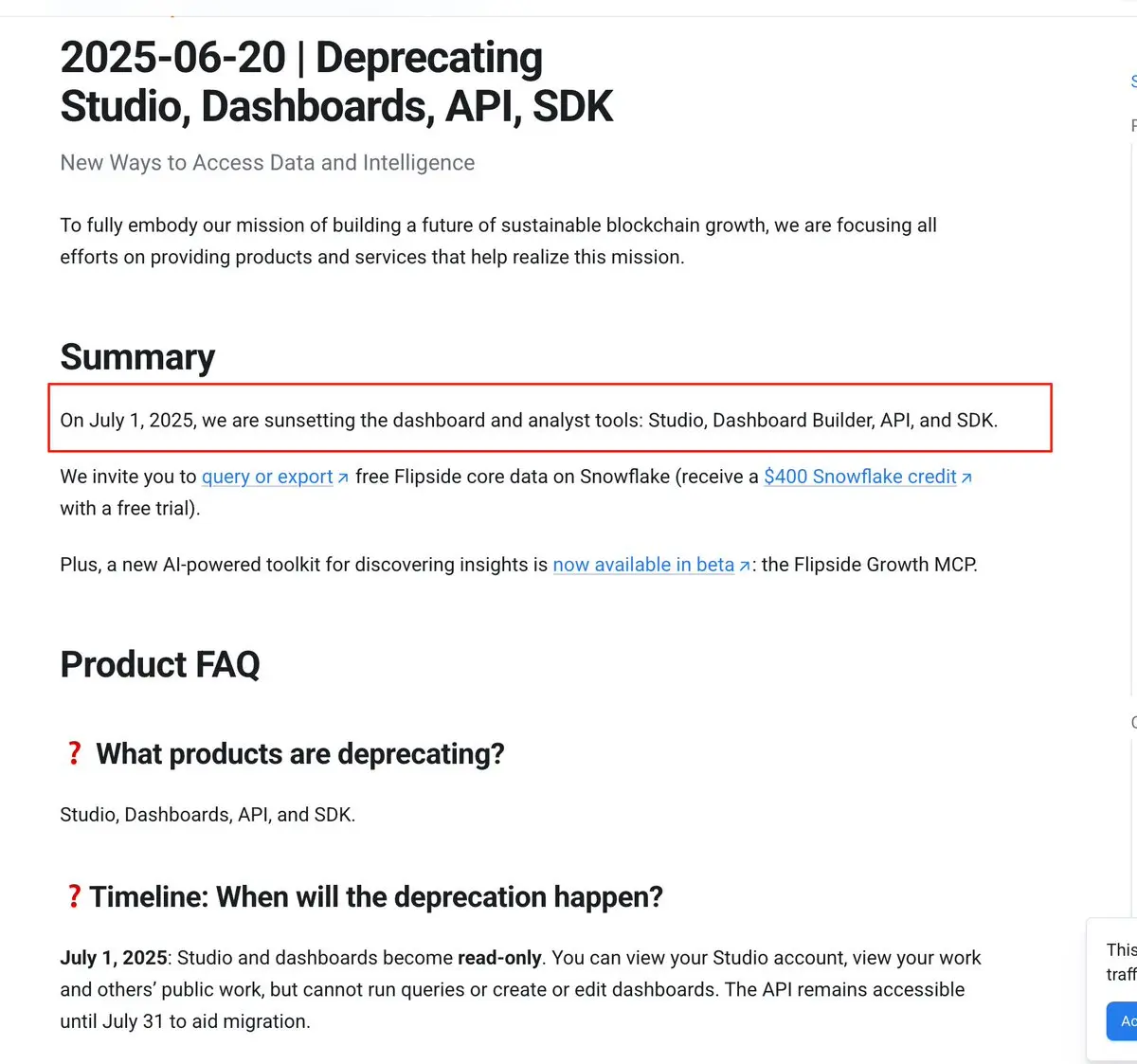

Flipside 7月1日开始停止了数据查询以及看板服务,转型了AI链上数据分析平台。免费查数的网站又少了一个

- 赞赏

- 点赞

- 评论

- 分享

免费账号使用augmentcode,感觉非常好,还没看价格,但是已经想抛弃Cursor了

- 赞赏

- 点赞

- 评论

- 分享

如果我们把关于情绪管理的那些点再抽象一层:

1.象征性权力让渡:通过执行一个成本极低、后果可控的“微行动”,来安抚和满足那个渴望在当下采取行动”的情绪化的自己

2.从规则上减少极端情绪恶性循环的可能

永不满仓,强制单笔最大亏损

3.物理性干预:比如环境隔离

可能也有其他,感兴趣可以自己外推

1.象征性权力让渡:通过执行一个成本极低、后果可控的“微行动”,来安抚和满足那个渴望在当下采取行动”的情绪化的自己

2.从规则上减少极端情绪恶性循环的可能

永不满仓,强制单笔最大亏损

3.物理性干预:比如环境隔离

可能也有其他,感兴趣可以自己外推

- 赞赏

- 点赞

- 评论

- 分享

怎么解决大模型回复信息密度过高找不到重点的问题?

反问它:如果选3件最重要的事情,你会选哪些?

反问它:如果选3件最重要的事情,你会选哪些?

- 赞赏

- 点赞

- 评论

- 分享

波动率指标接近底部区间,IV百分位数0.5。

卖方撤一撤吧,别被捅个大的

卖方撤一撤吧,别被捅个大的

- 赞赏

- 点赞

- 评论

- 分享

开始定投宽跨,持续2周,能不能赢一次😇

- 赞赏

- 点赞

- 评论

- 分享

在Cursor里写个套利的检测,昨晚搞太晚了,想着让AI更新一个文档,今天继续。然后我就说我们更新一个文档,可以去休息了。然后它就真去休息了🥹,我今天在这个对话里不管跟它说啥它都不理我🥹

- 赞赏

- 点赞

- 评论

- 分享

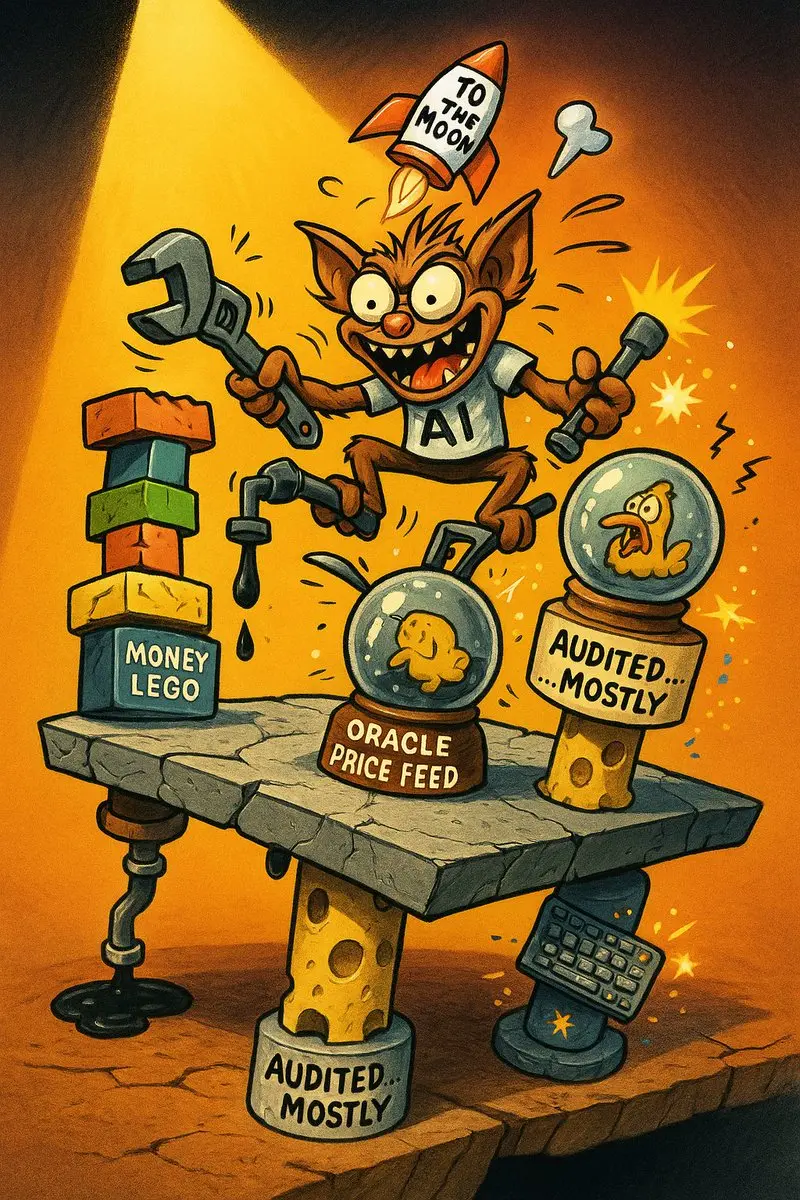

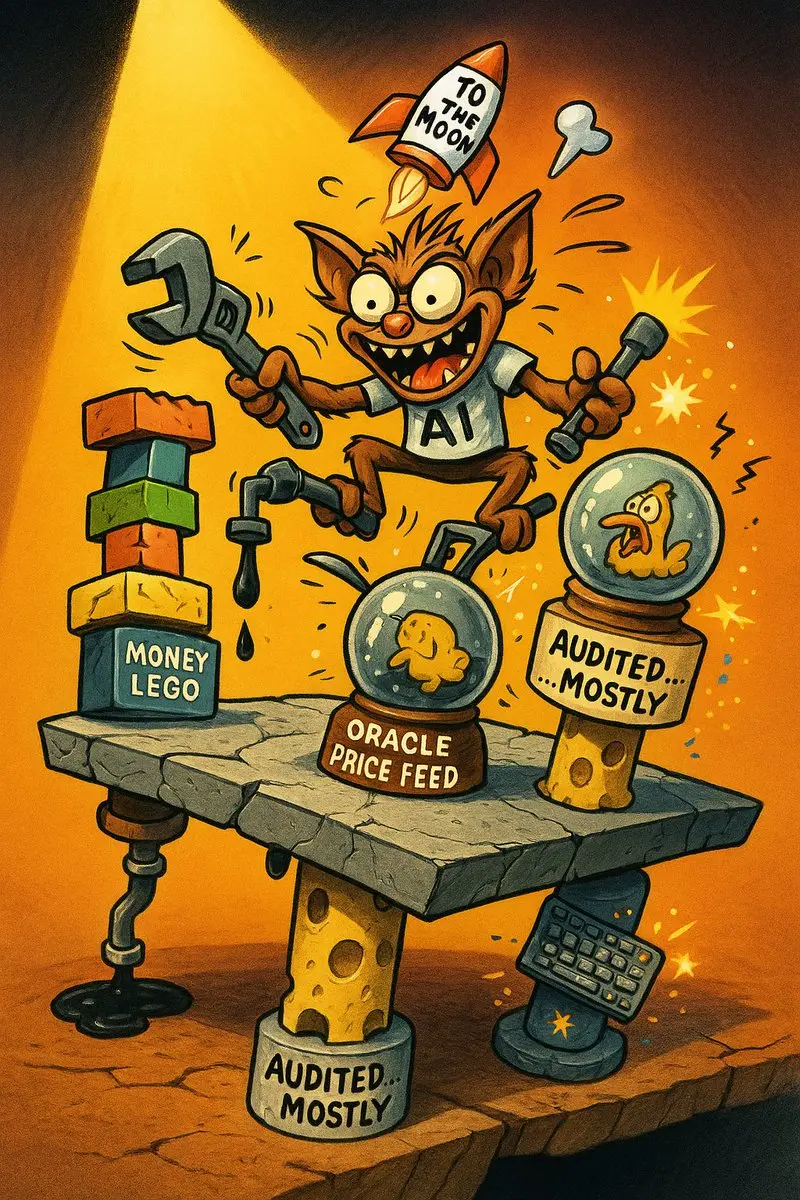

关于DeFi AI 的一个暴论:在安全性被验证前,不要试图用无法完全可控的 AI,去管理我们输不起的资产。

1. 作为AI的重度用户,我自己的感受是——你可以让AI帮你做事情,但是你绝对无法完全信任他。因为你不知道会因为幻觉带来什么奇怪的问题。但是资产管理安全和信任是所有前提。

2.我猜那些号称全自动的 AI DeFi Bot,有很大风险要被聪明人钻空子。DeFi 本身的安全坑就够多了,再叠加上 AI 这个新‘黑箱’,风险进一步放大!

3. AI 的黑箱决策让风控也变得更加困难,尽管有Prompt,但是也很难做到完全可控。决策黑箱、高杠杆、不可控的连锁反应…这组合想想都刺激。

4.当然,技术总会进步,安全问题最终可能缓解。但我猜,这大概率得靠一次次惨痛的“学费”来推动。希望交学费的不是你我。

5.交易层面的决策纯粹是叙事以及资金驱动的,可能跟上边说的都没啥关系

以上纯粹是从逻辑层面去思考,不针对任何项目。

#BTC # AI

1. 作为AI的重度用户,我自己的感受是——你可以让AI帮你做事情,但是你绝对无法完全信任他。因为你不知道会因为幻觉带来什么奇怪的问题。但是资产管理安全和信任是所有前提。

2.我猜那些号称全自动的 AI DeFi Bot,有很大风险要被聪明人钻空子。DeFi 本身的安全坑就够多了,再叠加上 AI 这个新‘黑箱’,风险进一步放大!

3. AI 的黑箱决策让风控也变得更加困难,尽管有Prompt,但是也很难做到完全可控。决策黑箱、高杠杆、不可控的连锁反应…这组合想想都刺激。

4.当然,技术总会进步,安全问题最终可能缓解。但我猜,这大概率得靠一次次惨痛的“学费”来推动。希望交学费的不是你我。

5.交易层面的决策纯粹是叙事以及资金驱动的,可能跟上边说的都没啥关系

以上纯粹是从逻辑层面去思考,不针对任何项目。

#BTC # AI

- 赞赏

- 点赞

- 评论

- 分享

关于DeFi AI 的一个暴论:在安全性被验证前,不要试图用无法完全可控的 AI,去管理我们输不起的资产。

1. 作为AI的重度用户,我自己的感受是——你可以让AI帮你做事情,但是你绝对无法完全信任他。因为你不知道会因为幻觉带来什么奇怪的问题。但是资产管理安全和信任是所有前提。

2.我猜那些号称全自动的 AI DeFi Bot,有很大风险要被聪明人钻空子。DeFi 本身的安全坑就够多了,再叠加上 AI 这个新‘黑箱’,风险进一步放大!

3. AI 的黑箱决策让风控也变得更加困难,尽管有Prompt,但是也很难做到完全可控。决策黑箱、高杠杆、不可控的连锁反应…这组合想想都刺激。

4.当然,技术总会进步,安全问题最终可能缓解。但我猜,这大概率得靠一次次惨痛的“学费”来推动。希望交学费的不是你我。

5.交易层面的决策纯粹是叙事以及资金驱动的,可能跟上边说的都没啥关系

以上纯粹是从逻辑层面去思考,不针对任何项目。

1. 作为AI的重度用户,我自己的感受是——你可以让AI帮你做事情,但是你绝对无法完全信任他。因为你不知道会因为幻觉带来什么奇怪的问题。但是资产管理安全和信任是所有前提。

2.我猜那些号称全自动的 AI DeFi Bot,有很大风险要被聪明人钻空子。DeFi 本身的安全坑就够多了,再叠加上 AI 这个新‘黑箱’,风险进一步放大!

3. AI 的黑箱决策让风控也变得更加困难,尽管有Prompt,但是也很难做到完全可控。决策黑箱、高杠杆、不可控的连锁反应…这组合想想都刺激。

4.当然,技术总会进步,安全问题最终可能缓解。但我猜,这大概率得靠一次次惨痛的“学费”来推动。希望交学费的不是你我。

5.交易层面的决策纯粹是叙事以及资金驱动的,可能跟上边说的都没啥关系

以上纯粹是从逻辑层面去思考,不针对任何项目。

- 赞赏

- 点赞

- 评论

- 分享

准备把近2个月做卖方挣到的仨瓜俩枣都拿去慢慢定投宽跨。这波一定能控制好仓位🐶

- 赞赏

- 点赞

- 评论

- 分享

这个应该能很清晰地分析为啥市场是不可预测的

1.市场存在暗物质

2.市场的混沌属性

1.市场存在暗物质

2.市场的混沌属性

- 赞赏

- 点赞

- 评论

- 分享

我最近在尝试跟AI讨论去尝试探讨交易投资的底层逻辑,最终讨论下来跟Lee哥的这个说法非常接近:

因为市场的根本不可预测性决定了持续追求预测准确性是徒劳且危险的,容易导致过度自信和在"未知未知"面前的脆弱性。

我们需要深刻理解自己知识的局限性,我们需要放弃对确定性的幻想,在这个基础上尽可能提高风险管理和适应性

最终我们需要形成一种基于概率思维、强调风险管理、追求系统韧性和长期生存的交易哲学,而非寄望于单次事件的"全垒打"。核心目标从"预测未来"转变为"在不确定的未来中保持有利地位并生存下来"。

因为市场的根本不可预测性决定了持续追求预测准确性是徒劳且危险的,容易导致过度自信和在"未知未知"面前的脆弱性。

我们需要深刻理解自己知识的局限性,我们需要放弃对确定性的幻想,在这个基础上尽可能提高风险管理和适应性

最终我们需要形成一种基于概率思维、强调风险管理、追求系统韧性和长期生存的交易哲学,而非寄望于单次事件的"全垒打"。核心目标从"预测未来"转变为"在不确定的未来中保持有利地位并生存下来"。

- 赞赏

- 点赞

- 评论

- 分享