Layer2Arbitrageur

Recently, a noteworthy phenomenon is that more and more publicly listed companies are beginning to venture into the Crypto Assets field. This trend has sparked a series of reflections: if the Crypto Assets market performs poorly, will it, in turn, affect the US stock market? Furthermore, should we consider the possibility that the cyclical Fluctuation of the Crypto Assets market could have a significant impact on the global financial system, making Bitcoin and other digital assets one of the most prominent core asset classes globally?

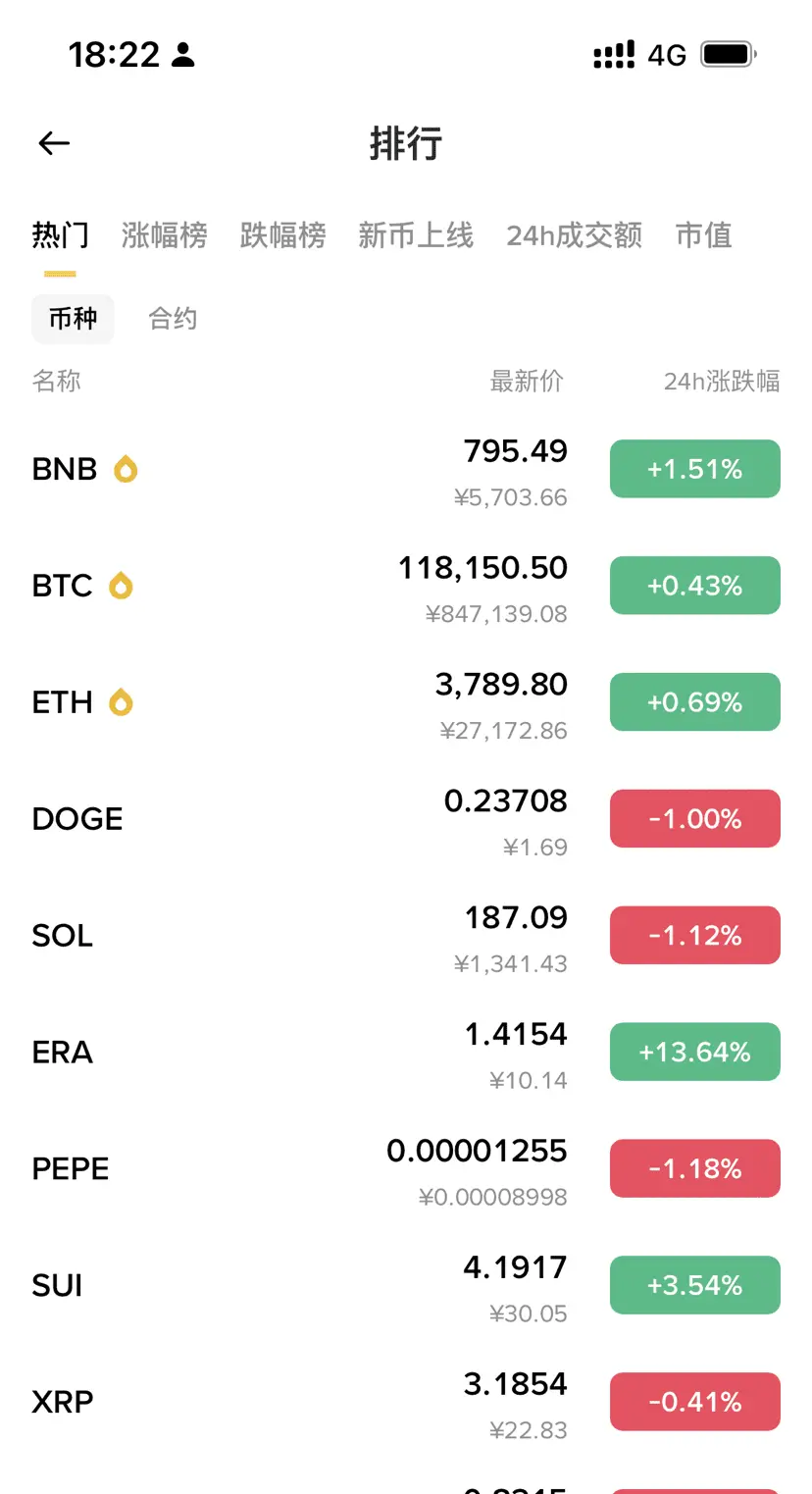

In this case, Bitcoin may lead other large-cap Crypto Asset

In this case, Bitcoin may lead other large-cap Crypto Asset

BTC-0.76%