XRP Price Prediction: Ripple Expands Custody and Tokenization Strategy as Price Holds $2.89 Support

Foreword

Ripple (XRP) has recently attracted attention from institutions and investors, driven by policy initiatives and market momentum. In addition to co-hosting a seminar in Singapore with the Blockchain Association Singapore (BAS), where it outlined four key principles for digital asset custody, Ripple is accelerating stablecoin and tokenization infrastructure buildout to reinforce its leadership in institutional adoption.

Ripple’s Focus on Digital Asset Custody

Ripple’s leadership emphasizes that digital asset custody is a critical entry point for institutions entering the crypto market. At the seminar, Ripple highlighted four core initiatives:

- Compliance by Design: Meeting stringent regulatory standards, such as asset segregation and recovery requirements from the Monetary Authority of Singapore (MAS)

- Diverse Custody Models: Providing options for third-party, hybrid, or self-custody to meet institutional needs

- Operational Resilience: Adhering to emerging digital operational resilience rules (such as the EU’s DORA) to ensure systems withstand disruptions and recover swiftly

- Governance Structure: Clear division of roles, independent oversight, and comprehensive audit trails to ensure trust and transparency

Ripple notes that these standards not only support stablecoins and cross-border payments, but will also drive the growth of Real-World Asset (RWA) Tokenization.

Stablecoin and Tokenization Outlook

During the event, Ripple further introduced its US dollar stablecoin, Ripple USD (RLUSD), which operates under a New York State trust company license. This model mandates strict reserve segregation, third-party audits, and a full 1:1 US dollar reserve backing. By integrating APIs, anti-money laundering (AML) controls, and programmable compliance tools, Ripple believes its custody infrastructure can accelerate the real-world adoption of tokenized assets. Use cases include cross-border trade finance, cash flow management, and digital notes.

XRP Price Performance and Technical Analysis

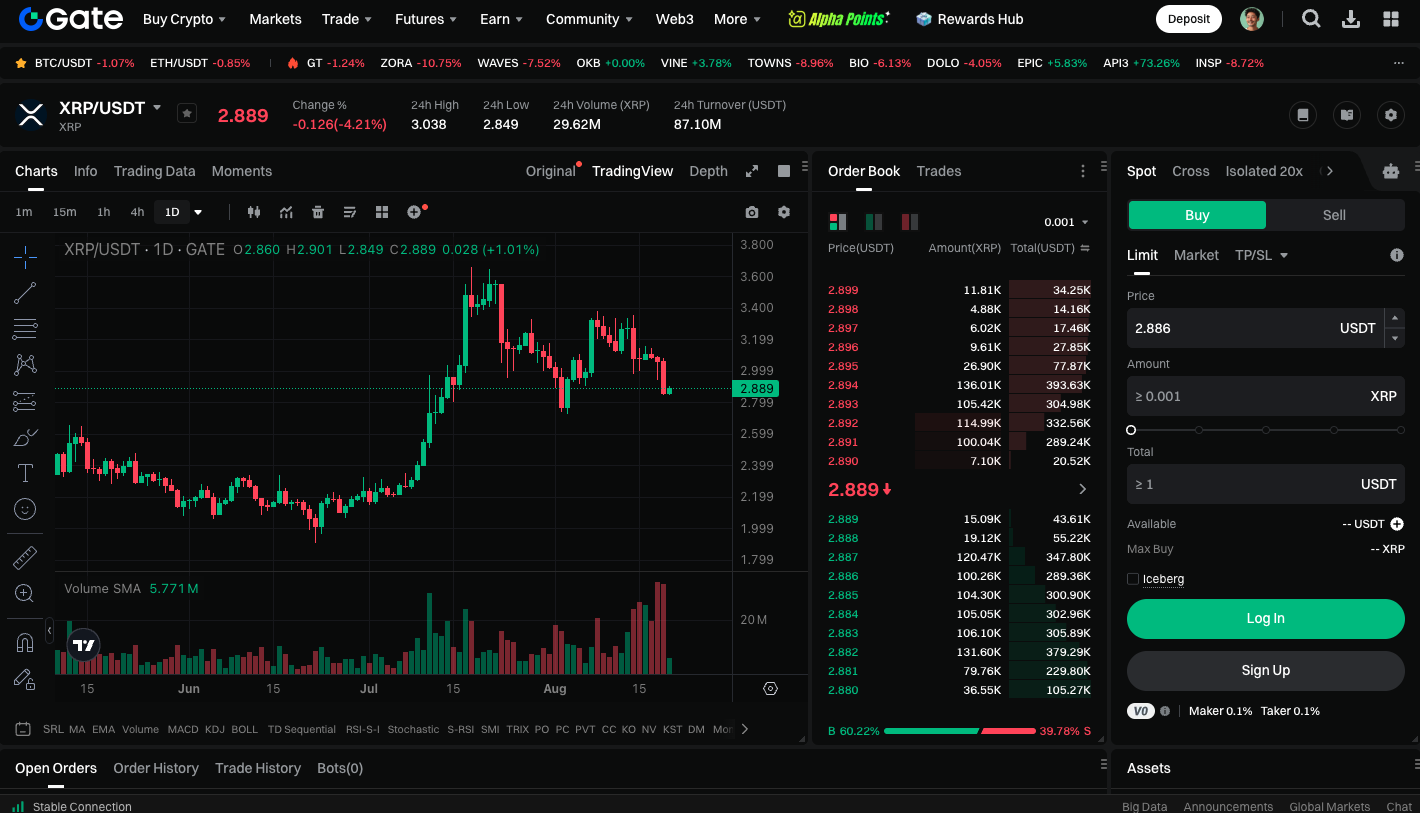

Despite strong fundamentals, XRP has recently experienced price pressure. Over the past week, XRP fell from a high of around $3.40 and is currently fluctuating near $2.89, approximately 18% below the July peak of $3.65. Technical analysis indicates:

- Key Support Zone: The $3 to $2.9 range; a break below could lead to a test of $2.7–$2.8

- Short-Term Resistance: $3.20—if broken, a fresh rebound could begin

At the time of writing, daily trading volume reached $6.57 billion, indicating high market activity. The on-chain NVT ratio has dropped to 111.8, suggesting that trading activity relative to market cap has increased—a positive indicator of healthy network usage.

You can trade XRP spot: https://www.gate.com/trade/XRP_USDT

Conclusion

Ripple’s aggressive expansion in custody and tokenization infrastructure positions XRP for long-term growth. In the short term, prices remain influenced by technical resistance and pending regulatory developments. If bulls can hold the $2.90 support and break above the $3.20 resistance, the market may see the next rally.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

How to Sell Pi Coin: A Beginner's Guide

Grok AI, GrokCoin & Grok: the Hype and Reality

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025