- Topic

40k Popularity

15k Popularity

10k Popularity

27k Popularity

76k Popularity

- Pin

- 🎉 The #CandyDrop Futures Challenge# is live — join now to share a 6 BTC prize pool!

📢 Post your futures trading experience on Gate Square with the event hashtag — $25 × 20 rewards are waiting!

🎁 $500 in futures trial vouchers up for grabs — 20 standout posts will win!

📅 Event Period: August 1, 2025, 15:00 – August 15, 2025, 19:00 (UTC+8)

👉 Event Link: https://www.gate.com/candy-drop/detail/BTC-98

Dare to trade. Dare to win. - 📢 Gate Square Exclusive: #WXTM Creative Contest# Is Now Live!

Celebrate CandyDrop Round 59 featuring MinoTari (WXTM) — compete for a 70,000 WXTM prize pool!

🎯 About MinoTari (WXTM)

Tari is a Rust-based blockchain protocol centered around digital assets.

It empowers creators to build new types of digital experiences and narratives.

With Tari, digitally scarce assets—like collectibles or in-game items—unlock new business opportunities for creators.

🎨 Event Period:

Aug 7, 2025, 09:00 – Aug 12, 2025, 16:00 (UTC)

📌 How to Participate:

Post original content on Gate Square related to WXTM or its - 🎉 Attention Alpha fans! Alpha’s latest TAG airdrop goes live today at 10 AM—first come, first served!

💰 Don’t forget to share your airdrop or points screenshot on Gate Square with the hashtag #ShowMyAlphaPoints# for a chance to win a share of the $200 token mystery box!

🥇 Top points winner: $100

✨ 5 outstanding posts: $20 each

📸 Pro tips:

Add a caption like “I earned ____ with Alpha. So worth it”

Share your points-earning tips or redemption experience for a better chance to win!

📅 Activity deadline: August 10, 18:00 UTC

Let’s go! See you tonight: https://www.gate.com/announcements/article - Hey fam—did you join yesterday’s [Show Your Alpha Points] event? Still not sure how to post your screenshot? No worries, here’s a super easy guide to help you win your share of the $200 mystery box prize!

📸 posting guide:

1️⃣ Open app and tap your [Avatar] on the homepage

2️⃣ Go to [Alpha Points] in the sidebar

3️⃣ You’ll see your latest points and airdrop status on this page!

👇 Step-by-step images attached—save it for later so you can post anytime!

🎁 Post your screenshot now with #ShowMyAlphaPoints# for a chance to win a share of $200 in prizes!

⚡ Airdrop reminder: Gate Alpha ES airdrop is - Hey Square fam! How many Alpha points have you racked up lately?

Did you get your airdrop? We’ve also got extra perks for you on Gate Square!

🎁 Show off your Alpha points gains, and you’ll get a shot at a $200U Mystery Box reward!

🥇 1 user with the highest points screenshot → $100U Mystery Box

✨ Top 5 sharers with quality posts → $20U Mystery Box each

📍【How to Join】

1️⃣ Make a post with the hashtag #ShowMyAlphaPoints#

2️⃣ Share a screenshot of your Alpha points, plus a one-liner: “I earned ____ with Gate Alpha. So worth it!”

👉 Bonus: Share your tips for earning points, redemption experienc

Considering the background of the yen's return to depreciation | Yoshida Tsune's Forex Daily | Moneyクリ Money's Media for Investment Information and Financial Assistance by Monex Securities

Is the weak yen a correction of the "tariff shock"?

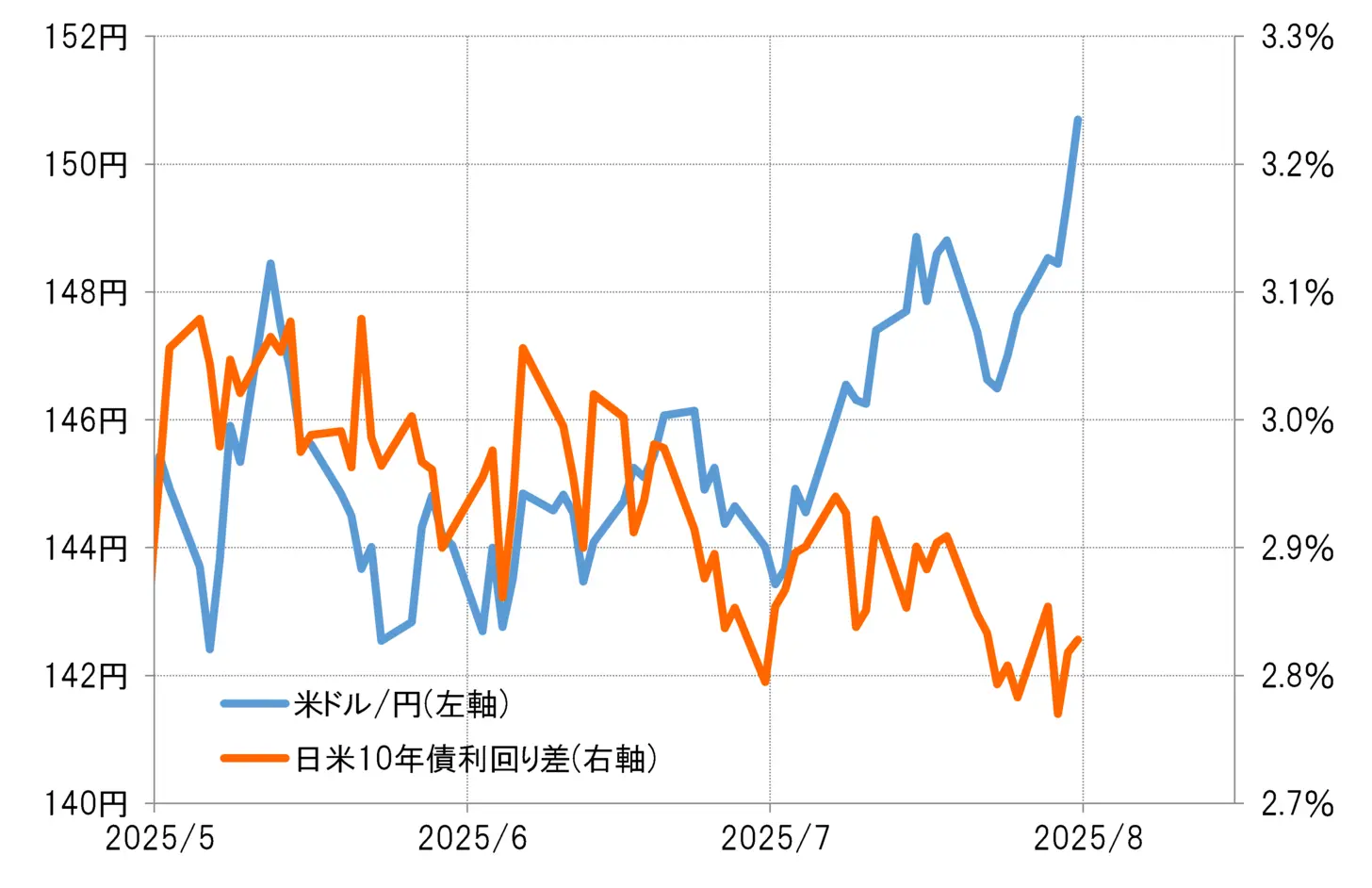

When looking at the relationship between the USD/JPY and the interest rate differential between the U.S. and Japan (with the U.S. dollar being dominant and the yen being weak) since May, the recent rise to nearly 150 yen is far beyond what can be explained by the interest rate differential (see Chart 1). Therefore, it cannot be said that the depreciation of the yen is solely due to the decline in Japanese interest rates resulting from political instability in Japan, which has raised concerns about the economic outlook.

[Figure 1] USD/JPY and the US-Japan 10-Year Bond Yield Spread (from May 2025) Source: Created by Monex Securities from Refinitiv data

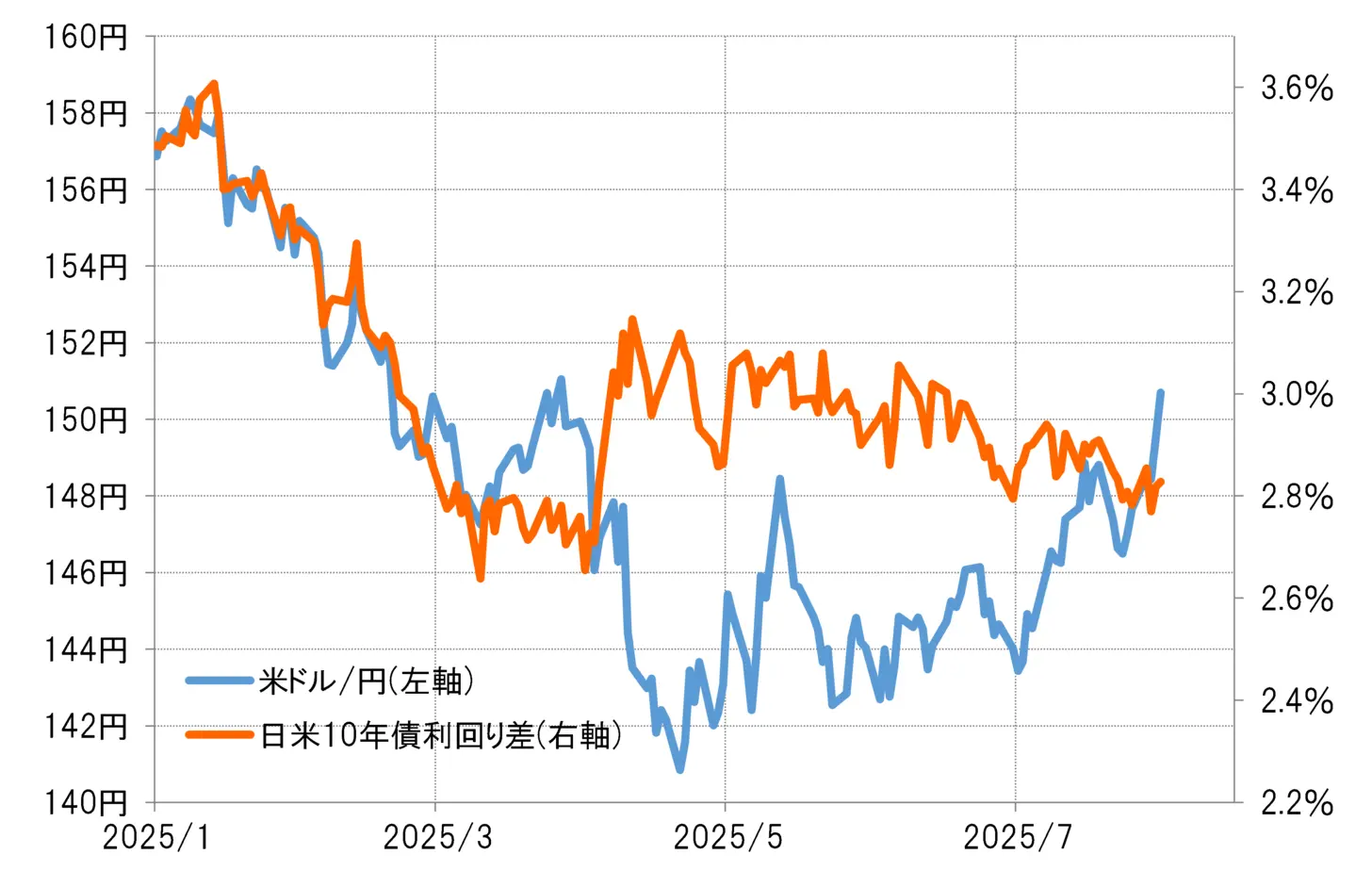

However, the two diverged significantly after the so-called "tariff shock" in April. This was due to a "bad interest rate hike" where U.S. stocks and the U.S. dollar plummeted despite rising U.S. interest rates. The recent rise in the USD/JPY can also be seen as a correction of the divergence from the U.S.-Japan interest rate differential caused by this "bad interest rate hike" (see Figure 2).

Source: Created by Monex Securities from Refinitiv data

However, the two diverged significantly after the so-called "tariff shock" in April. This was due to a "bad interest rate hike" where U.S. stocks and the U.S. dollar plummeted despite rising U.S. interest rates. The recent rise in the USD/JPY can also be seen as a correction of the divergence from the U.S.-Japan interest rate differential caused by this "bad interest rate hike" (see Figure 2).

[Figure 2] USD/JPY and the U.S.-Japan 10-Year Bond Yield Spread (from January 2025) Source: Created by Monex Securities from Refinitiv data

After the "tariff shock," a "triple decline" in U.S. stocks, bonds, and currency occurred, which was also referred to as "selling the U.S." It is believed that the pessimism towards U.S. assets has been corrected, leading to a return to a stronger U.S. dollar.

Source: Created by Monex Securities from Refinitiv data

After the "tariff shock," a "triple decline" in U.S. stocks, bonds, and currency occurred, which was also referred to as "selling the U.S." It is believed that the pessimism towards U.S. assets has been corrected, leading to a return to a stronger U.S. dollar.

The structure that makes it easy to expand speculative yen selling due to a significant interest rate differential and the yen's disadvantage remains unchanged.

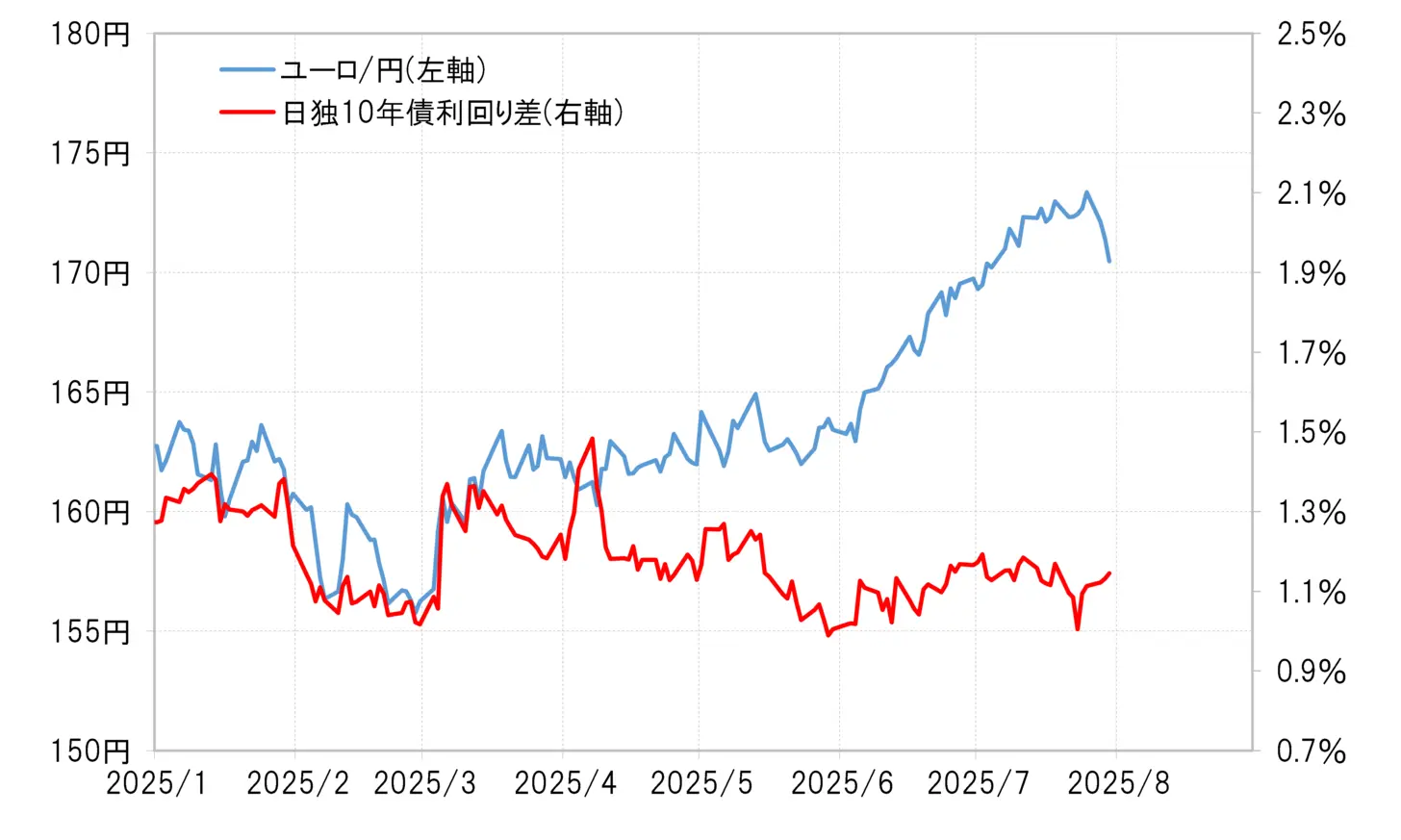

However, aside from the depreciation of the yen against the US dollar, when looking at the yen's depreciation against the euro, it significantly deviates from the Japan-Germany interest rate differential (see Chart 3). From this, it is hard to shake the impression that the main driver behind the movement back towards yen depreciation is simply speculative yen selling based on the interest rate differential.

[Chart 3] Euro/Yen and the Difference in 10-Year Bond Yields between Japan and Germany (From January 2025) Source: Created by Monex Securities from Refinitiv data

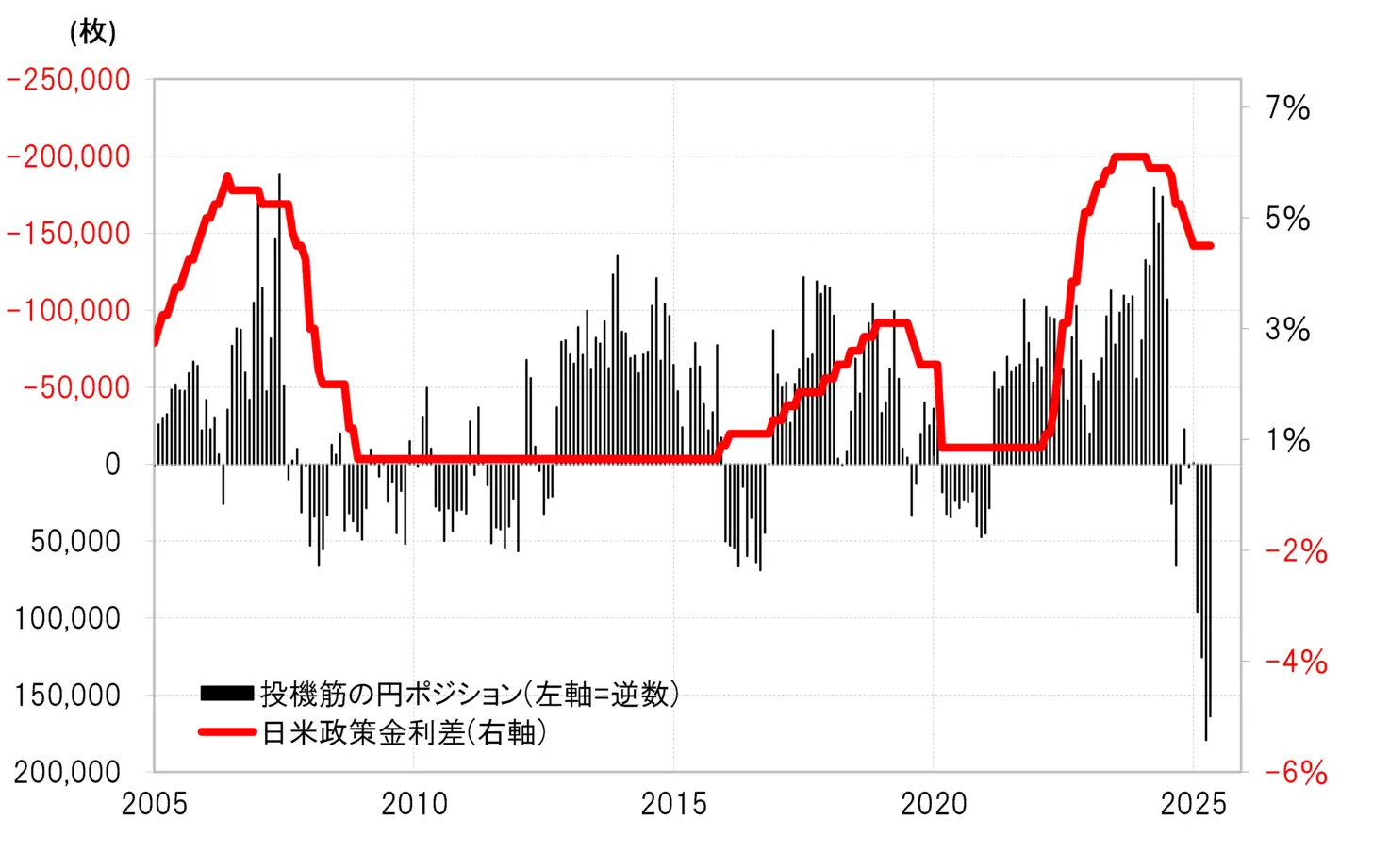

Looking at the CFTC (Commodity Futures Trading Commission) statistics reflecting hedge fund trading, the speculative yen positions show that, unlike the rapid expansion of yen selling seen in the yen depreciation phase of 2024, there has been an expansion of yen buying that may be considered irrational given the significant interest rate differential leading to yen underperformance, which has been a characteristic since the beginning of 2025 (see Chart 4).

Source: Created by Monex Securities from Refinitiv data

Looking at the CFTC (Commodity Futures Trading Commission) statistics reflecting hedge fund trading, the speculative yen positions show that, unlike the rapid expansion of yen selling seen in the yen depreciation phase of 2024, there has been an expansion of yen buying that may be considered irrational given the significant interest rate differential leading to yen underperformance, which has been a characteristic since the beginning of 2025 (see Chart 4).

[Figure 4] CFTC Statistics on Speculative Yen Positions and the Japan-U.S. Policy Interest Rate Differential (2005–) Source: Created by Monex Securities from data provided by Refinitiv.

The selling of yen accompanying the closing of long yen positions may be contributing to a return to yen depreciation that is difficult to explain by changes in interest rate differentials. Considering the significant interest rate differential disadvantage of the yen, the expansion of yen buying by hedge funds among speculators is likely to be an exception, while other speculators are likely expanding their speculative yen selling as usual.

Source: Created by Monex Securities from data provided by Refinitiv.

The selling of yen accompanying the closing of long yen positions may be contributing to a return to yen depreciation that is difficult to explain by changes in interest rate differentials. Considering the significant interest rate differential disadvantage of the yen, the expansion of yen buying by hedge funds among speculators is likely to be an exception, while other speculators are likely expanding their speculative yen selling as usual.

Looking at the above, the main reason for the return to a strong US dollar and a weak yen is still likely the significant interest rate differential disadvantage of the yen. Additionally, the sluggish movement in the narrowing of this interest rate differential disadvantage is likely greatly influenced by the unexpectedly strong state of the US economy, as indicated by the 3% growth rate of the real GDP for the second quarter of 2025 announced on July 30, despite the tariff policies of the Trump administration, which has limited the decline in US interest rates.

Trade and service deficit reduced to levels close to those of 2021

Finally, let's take a look at the impact of the trade and services deficit, which has become a symbol of the decline of the Japanese economy. Although the trade and services deficit surged to a record high in 2022, it has since significantly shrunk, and recently, on a quarterly basis, it has continued to hover around the levels seen in 2021 (see Chart 5).

[Figure 5] US Dollar/Yen and Trade & Services Balance (2000 onwards) Source: Created by Monex Securities from Refinitiv data.

In 2021, the USD/JPY was fluctuating around the 110 yen level. The trade and services deficit, which has shrunk to a level close to that time, has not had much impact on the recent return of a stronger US dollar and a weaker yen over the past few months.

Source: Created by Monex Securities from Refinitiv data.

In 2021, the USD/JPY was fluctuating around the 110 yen level. The trade and services deficit, which has shrunk to a level close to that time, has not had much impact on the recent return of a stronger US dollar and a weaker yen over the past few months.